Home » Features » Production Profiles »

HOW CVF FACILITATES FINANCE FOR FILMMAKING

CVF is backing the film and TV industry thanks to its specialist expertise in asset financing, as the firm’s director Rebecca Price explains.

Looking to buy that set of vintage primes that you’ve had your eye on? If you go straight to a traditional bank for a loan, you’re likely to get laughed at.

“Banks are very good at understanding anything with four wheels, or machinery, but to them, it’s absurd that you can spend a quarter of a million pounds on a set of lenses,” says Creative Vision Finance (CVF) director Rebecca Price. She adds that banks would classify typical assets owned and purchased by filmmakers as ‘soft’ assets.

“They don’t see any security in them,” she explains. “That’s not the case, certainly with lenses, as they’re actually appreciating assets.”

CVF isn’t a bank, however. 99% of the clients of this specialist asset finance company are in the film and TV industry and live entertainment. And although relatively new, having been founded just two years ago, the team at CVF’s expertise and history within the industry allows it to do deals that a high street bank just doesn’t understand.

“We’re experts, we’re very niche in terms of what we do,” says Price. “When we’re looking at getting money in place for our customers, we understand their business, how they work and the nuances of the industry, but we also understand the assets that they’re trying to fund.

“And we do everything. We don’t just fund the tangible asset, like the camera or the lens, we do tripods, we do cards, we do filters, the battery, and the whole shooting kit. Because without those things, you haven’t actually got a working camera. There was quite a lot of education needed with our panel of funders to get them to understand that.”

Another crucial factor in the funders’ confidence is a close mutual relationship with leading cine, broadcast, and pro video solutions provider CVP. Price describes it as “an expert reseller in the background ready to take on those assets from the banks if things go wrong”.

“On that basis, we’ve got some unique funders that wouldn’t deal with any of my competitors,” she says. “That means that our decline rates are very low; we have funders able to facilitate finance for most people.”

CVP shares resources such as marketing, HR, and payroll with CVF, while the finance company in turn is on hand to facilitate sales for CVP.

“That was originally why we were set up,” says Price. “CVP was being asked continually to stand behind deals and were being asked to do quite a lot of work by the finance companies to get deals over the line. At the same time, I was frustrated by my role. We explored working together and that’s how CVF was born.

“Probably 75% of the business we do is joint, with CVP as the supplier,” she continues. “I have lots of legacy customers from 20 years in the industry that we both mutually work with. The other 25% is again drawn from my existing customer base, but are people that might never buy from CVP, as well as in some instances CVP’s competitors.”

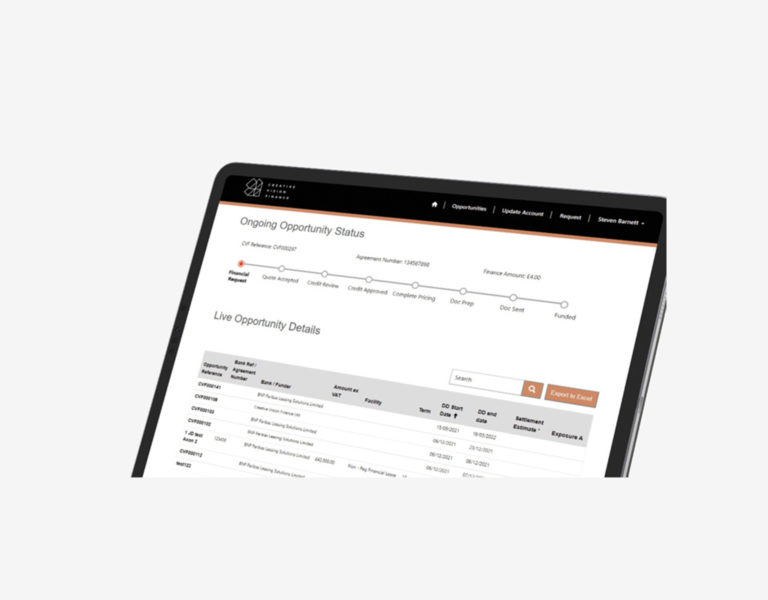

A third USP is a strong investment in technology. “We have the most up-to-date CRM tools in terms of managing the customer workflow,” says Price. “Customers have a portal that they can log into 24/7 to see what’s going on with their finance deals, see when their monthly repayment is coming out, how much it is, and when it expires.

“The customer’s core business is shooting, or post-production, or whatever. The financing is a sideline, it shouldn’t be something that distracts from what earns the money. Whenever [financing] becomes complex, complicated, and convoluted, we’re not doing the right job.”

Price relates a recent example where a customer was flying out to a shoot and had run out of time to finalise a deal for kit before the flight. “He couldn’t find the documents in time, so to solve this we proposed that we go and pick up the kit for him, sign the finance document, then meet him on the way to the airport. It’s just about going that extra mile and facilitating our clients, to be able to give them a level of service that you just don’t really get in this day and age.”

The company offers a range of solutions, tailored to suit the type of situation customers are in. “A big issue at the moment is that everyone is stretching out their payment terms,” Price says. “You may be a very successful business with a massive amount of work on the go, but your clients are now paying you on 60 or 90 days. People are defaulting more, and the financial situation is having an impact on people’s financial stability.”

Price says that doesn’t mean solutions aren’t available. “If [prospective customers] have got good historic data or they’ve got a contract, we can usually get to a deal. We’re not black and white in terms of the way that we do business. We want to understand why people are buying the kit; is it for a contract? Might they not get paid for 90 days? That’s fine, if there’s a good rationale behind it, then we feel comfortable with a deal.”

Price gets the most satisfaction from helping people starting out. “We’ve done a few deals where we’ve assisted people on getting their careers off the ground, like helping facilitate a camera operator who has moved up to DP and wants to invest more heavily in his kit,” she says. “I’m constantly intrigued and proud of the things that my clients do. Finance is not interesting, but my clients are very interesting. They make the creative industry such a force within the British economy, and it’s cool to help play a little part in that.”