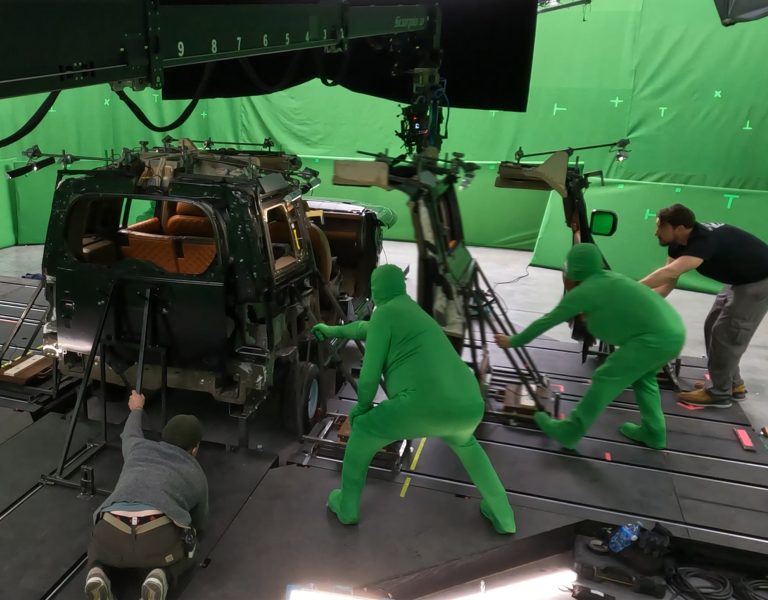

The Chancellor of the Exchequer used the Government’s first Autumn Budget to confirm an increase in the UK’s tax incentive for spending on Visual Effects (VFX) in the UK.

The Chancellor confirmed proposals, first raised in the March 2024 Budget, that from 1st April 2025, VFX costs in the UK will attract an increase in the rate of relief to 39% (29.25% after tax). This represents an increase from the previous rate of 25.5% net – and will be exempt from the overall Audio-Visual Expenditure Credit’s 80% cap on qualifying expenditure.

Responding to the Budget statement, the British Film Commission, the organisation responsible for attracting and maintaining inward investment in film and high-end TV, welcomed the various measures.

Adrian Wootton OBE, Chief Executive of the British Film Commission, said:

“UK film and TV is globally admired, and a key sector driving economic growth. Our VFX sector is one of the jewels in the UK industry’s crown, with a depth of creative and technical expertise. But these are competitive times. Productions are looking globally for the best talent and incentives to guide their investment decisions. Any new measures must address intensifying global competition and help us put our best foot forward. Today’s confirmation of the VFX tax credit increase doubles down on UK strengths and will drive up investment. It is not only welcome, but essential to support our sector and wider UK growth.”

On Generative Artificial Intelligence (AI) inclusion:

“We’re delighted that HM Treasury has listened to industry feedback on Generative AI, and included these costs in the overall VFX tax credit enhancement. The BFC pressed for this in our consultation response and we believe this will play an important part in keeping our VFX sector future-proofed and globally competitive.”

On £25m investment for Crown Works Studios, Sunderland:

“We welcome the Government’s commitment to supporting studio infrastructure across the UK’s four nations and regions.”

Today’s announcement builds on measures previously announced by Government to further enhance the UK film, TV and animation Audio-Visual Expenditure Credits, future-proofing our sector and further enhancing the UK film and TV industry.